- agastya9

- 01 Nov 2024 05:31 AM

- Inflation

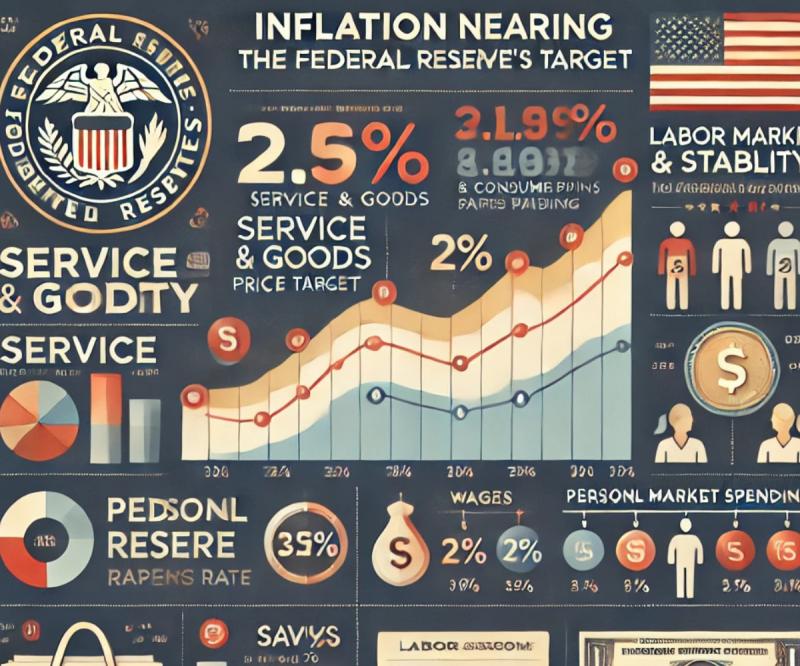

Inflation inched up in September, approaching the Federal Reserve’s target, according to a Commerce Department report released Thursday.

The personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure, rose by 0.2% for the month on a seasonally adjusted basis. Year-over-year, inflation was at 2.1%, aligning with Dow Jones forecasts. While the Fed's goal remains a 2% annual inflation rate—a level last seen in February 2021—the September rate marked a slight decrease of 0.2 percentage points from August.

Despite nearing the target, core inflation, which excludes volatile food and energy prices, stood at 2.7% annually after a 0.3% monthly increase. This rate was marginally higher than anticipated, though unchanged from August.

Inflation growth was largely driven by services, which saw a 0.3% increase, while goods prices fell by 0.1%, the fourth deflationary figure in five months for goods. Housing prices continued to ease, growing by 0.3%, while energy goods and services dropped by 2%.

The report arrives as markets expect the Fed to lower its benchmark short-term interest rate next week. The Fed cut the rate by a half percentage point in September, an unusual move amid economic expansion.

Fed officials have expressed optimism about inflation reaching the target but remain cautious about the labor market, even though hiring remains strong and layoffs are minimal. Reinforcing this view, a separate Labor Department report showed initial unemployment claims fell by 12,000 to 216,000 for the week ending Oct. 26, below the forecasted 230,000.

Meanwhile, income and spending remained resilient in September, with personal income rising by 0.3%—slightly above August’s increase and in line with expectations—and consumer spending up by 0.5%, surpassing projections by 0.1 percentage points. However, the personal saving rate dipped to 4.6%, its lowest point this year.

Additionally, the Bureau of Labor Statistics reported a 0.8% increase in the employment cost index for Q3, 0.1 percentage points below forecast. Over 12 months, wages, salaries, and benefits rose by 3.9%, compared to a 2.4% increase in the consumer price index.